According to statistics, the AGV/AMR-specific LiDAR market in China saw sales of approximately 210,000 units in 2023, with a market size of about 800 million yuan. This high growth over the past two years is primarily due to the rapid expansion of the AGV/AMR industry, especially the accelerating adoption of natural navigation AMRs, which has further increased demand for LiDAR.

China’s LiDAR industry currently includes both domestic and international LiDAR manufacturers, as well as optical component suppliers. As of September 2024, there are 702 registered companies in China whose business scope or company profile includes “LiDAR” (including relevant companies in the supply chain), with 560 companies actively operating. Notably, 2019 saw the highest growth in registrations, with 74 new companies joining the market that year.

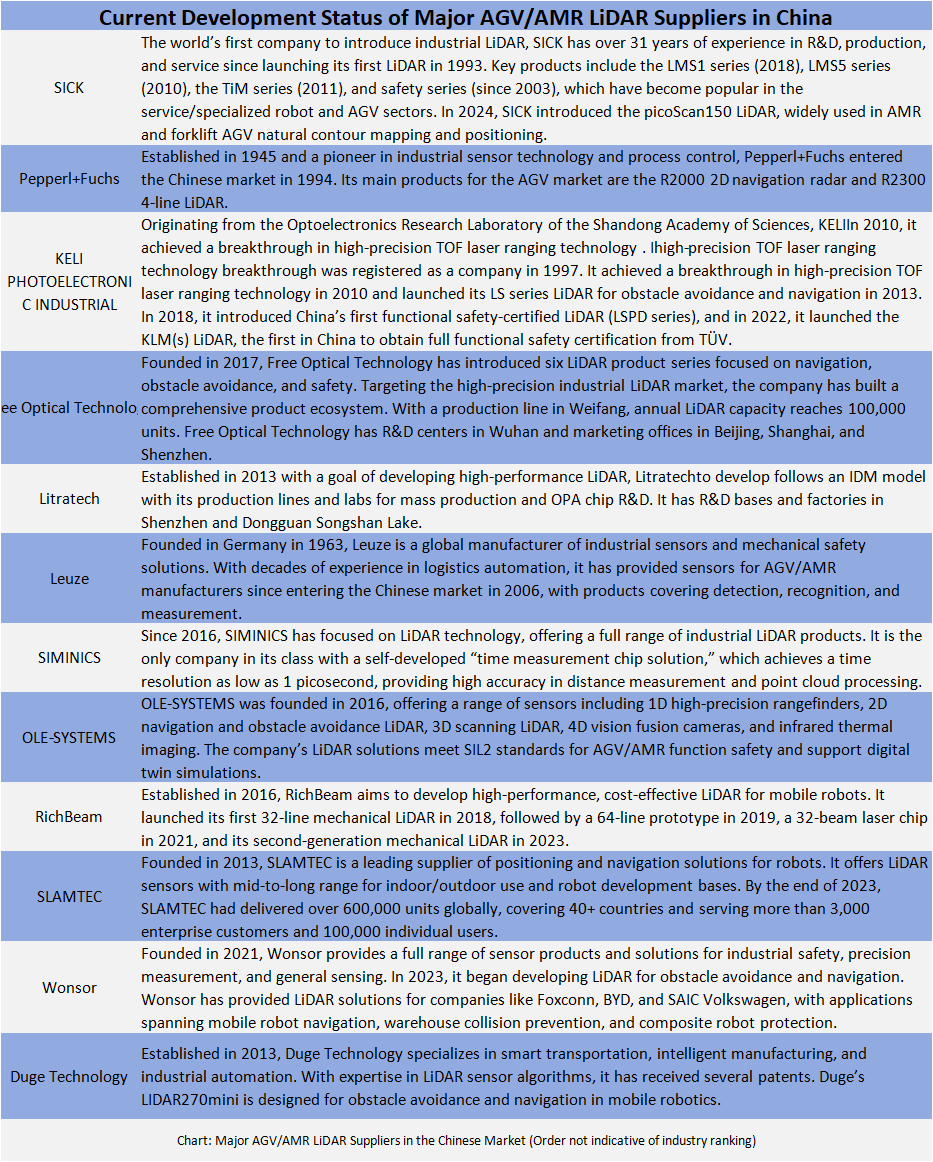

Today, over 50 companies in the Chinese market provide LiDAR specifically for AGV/AMR applications, including domestic and international brands. These companies are competing for market share through technological innovation, product upgrades, and market expansion.

In addition to the companies mentioned, firms such as Livox, Intelly, Pacecat, Hinson, LeiShen Intelligent System, and VanJee Technology have also developed targeted products for AGV/AMR applications, with mature applications already in place. As the mobile robotics industry rapidly grows, especially with rising autonomy requirements, the use of LiDAR in mobile robotics is deepening and attracting more entrants. The current competitive landscape is characterized by the entry of autonomous driving LiDAR manufacturers, cost control efforts, and applications in complex, specialized scenarios. These trends are not only driving market growth but also creating more opportunities and challenges for manufacturers. With continuous advancements in technology and an expanding market, the AGV/AMR LiDAR market is expected to experience a broader development outlook.